Dark Side of the Street (Edition #2)

“In the short run, the market is a voting machine. In the long run, it’s a weighing machine.”

- Warren Buffett

Upcoming Special Situations

Risk Arbitrage Opportunities

Microsoft Corporation (NASDAQ: MSFT) has agreed to acquire Activision Blizzard (NASDAQ: ATVI) in an all-cash deal for $95/share (~$68.7B). ATVI is currently trading near $82/share which is a spread of about 15%. This is a fairly large spread for an acquisition of its size showing the market’s skepticism of a deal closing. Possible regulatory issues are the main risk with this deal.

The Wall Street Journal’s article “Microsoft-Activision Deal Likely to Face Close Antitrust Scrutiny” stated the following on the possible regulatory issues of this merger:

“Questions likely to arise include whether Microsoft’s ownership of Activision Blizzard would create unfair competition against its main rivals in game hardware. The deal would allow Microsoft to offer more exclusive content on its Xbox consoles, potentially forcing consumers to choose them over Sony Group’s PlayStation and Nintendo’s Switch machines.”

This article also alluded to the idea that the merger may not finalize until 2023. This will give investors plenty of time to investigate/research to determine the likelihood of the merger being completed.

Casper Sleep (NYSE: CSPR) has agreed to be acquired by Durational Capital Management LP at $6.90/share. This transaction will take Casper private and therefore no longer trade publically. SEC Filings show that on Jan. 19th, 2022, CSPR shareholders voted in favor of the deal which is now expected to finalize the week of Jan. 24th, 2022. The stock is currently trading near $6.35/share, showing a spread of 55 cents/ share or a potential gain of 8.66%.

If you’re new to special situations see some of my learning resources on my substack home page to learn more!

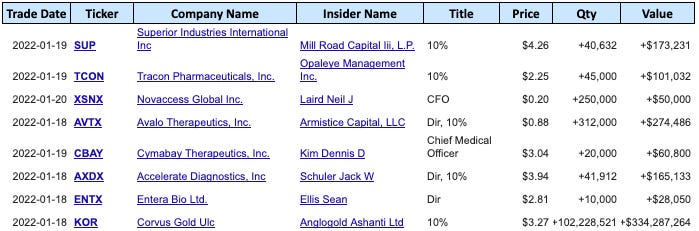

Recent Insider Buying

Large Micro Cap Purchases

Source: OpenInsider.com

Top News of the Week

“From tech to financials, here are dozens of inflation-sensitive stocks that crush it when prices are rising, from Credit Suisse.” by Barbara Kollmeyer of MarketWatch

“Jonathan Golub, chief U.S. equity strategist, and Patrick Palfrey, senior equity strategist, told clients that they expect inflation will move higher and stay there longer, due to several factors, including a strong economy and higher commodity and home prices.”

“The SPAC Ship is Sinking. Investors Want Their Money Back” by Amrith Ramkumar of WSJ

“Shares of half of the companies that finished SPAC deals in the last two years are down 40% or more from the $10 price where SPACs typically begin trading, erasing tens of billions of dollars in startup market value. Losses top 60% from the peak about a year ago for many once-hot names like the sports-betting company DraftKings Inc. and space-tourism firm Virgin Galactic Holdings Inc., founded by British billionaire Richard Branson.”

“Why Matterport is the Gateway to the Metaverse” by Ashley Cassell of InvestorPlace

“In the metaverse, you could explore the Australian Outback more easily than you can get into an Outback Steakhouse in your hometown. You could see La Bohème at the Sydney Opera House, check out the street art on Hosier Lane in Melbourne (shown below), then stroll the Swan River in Perth – all with zero travel time.”

Top Micro Cap Movers this Week

Top 10 Gainers

Top 10 Losers

Special Situation Watchlist

Colfax Corp (NYSE: CFX) - Spinoff

No Update

Exelon Corporation (NASDAQ: EXC) - Spinoff

No Update